top of page

GOLD - How Many Investments

Have All These Advantages?

Gold is not used as a currency today, but its role as money makes it superior to any currency. In fact, gold has been money longer than any currency in history. Gold has been a store of value for at least 3,000 years, while one of the longest currencies in history, the British Pound, is about 1,200 years old. One of the crucial promises of money is that it serve as a long-term store of value. Gold fulfills this promise better than any fiat currency. Look how much purchasing power all major government currencies have lost compared to gold.

1

Gold is Money

If you buy physical gold, you can hold it in your hand, something you can’t do with most any other investment. Real gold can’t be destroyed by fire, water, or even time. And unlike other commodities, gold doesn’t need feeding, fertilizer, or maintenance. There’s another advantage to gold being a tangible asset: it can’t be hacked or erased. Unlike brokerage accounts, bank accounts, and payment services like credit cards, gold bullion is out of reach from hackers and identity thieves. In today’s world, it’s probably a good idea to have some of your wealth outside of digital form. If the internet isn’t available or your online world comes crashing down, those gold Canadian Maples you possess aren’t affected. In fact, in that scenario, they could be a lifesaver.

2

Tangible Asset

No Counterparty Risk

3

If you hold gold bullion, no paper contract is needed to make it whole. No middleman or other party is necessary to fulfill a contractual obligation. That’s because gold is the only financial asset that is not simultaneously some other entity’s liability. This is important because gold will be the last man standing when bubbles pop or a crisis hits. That’s a powerful tool to have in your portfolio when things start to go wrong in your country or economy. It also means gold won’t go to zero. It’s never happened in its 3,000+ year history. That’s a powerful feature, especially if you asked former shareholders of companies like Bear Stearns, Enron, or Lehman Brothers.

Private and Confidential

4

How many assets can you say that about in today’s world? If you want a little privacy, physical gold is one of the few assets that can provide it. Note that you must still report any gain on your income taxes. Here are the basic guidelines on reporting and paying taxes on gold. Gold is one of very few investments that can be anonymous. If you choose, no one has to know you own it. Virtually any other investment you may make does not have this benefit.

Liquid and Portable

5

Gold is also ideal because it is easy to sell, and can be carried in your pocket anywhere you go. Gold is highly liquid. Virtually any bullion dealer in the world will recognize a Gold Canadian Maple and buy it from you. You can sell it to your local coin shop, a private party, or an online dealer. It can always be sold for cash or traded for goods. The process is frequently quicker than selling a stock in your brokerage account—it usually takes 3 business days for settlement before cash can be transferred to your bank account or a check mailed. And other collectibles, like artwork, could take longer to sell, have a small customer base, and would likely entail a big commission. This liquidity means you can take gold with you literally anywhere in the world.

Easy to Store

One question that comes up with physical gold is the cost of storing it. While professional storage does come with a fee, vaulting charges are typically low, and compare a small storage bill to the costs and headaches of, say, real estate. Just lock your gold away until you need it; no late renter payments, calls to fix a broken toilet, or complicated tax issues. Of course you can always hide or secure gold in your home, too. Here are some ideas from our silver storage article, which also apply to gold. Keep in mind that gold is value dense. That means it packs a lot of value in a small space. You can hold $50,000 of gold in the palm of your hand—or store it in a small space in your home. At any price above $1,200/ounce, you can store more value in a safe deposit box with gold than stacks of dollar bills.

6

No Specialized Knowledge

7

Can you spot a real diamond? Can you look at two paintings and tell which is the fake Van Gogh? What stamps, baseball cards, and antique furniture pieces are more valuable than others? Gold bullion requires none of this - No special skills, training, or equipment needed. You can buy rare gold coins, but this is the world of the collector, which most investors should avoid. You’re not speculating on a numismatic coin someday fetching a higher premium than what you paid; you’re investing in gold bullion to protect you against crisis and shield you from a loss in purchasing power. No rare coins needed. Buying gold bullion is relatively straightforward.

Protection against Government

8

You don’t have to be a conspiracy nut to understand that governments sometimes overreach. They can freeze bank accounts, garnish wages, and even confiscate funds. Talk to people who were victims of these actions and they’ll tell you they had no warning. In an economic or financial crisis, these actions increase. The government desperately needs revenue, and they tend to be more aggressive in their enforcement. Or, they simply pass news laws and regulations to suit their needs at the time. It’s happened with virtually every government in history, and it’ll happen again, especially in a crisis situation.

Use as a Hedge

9

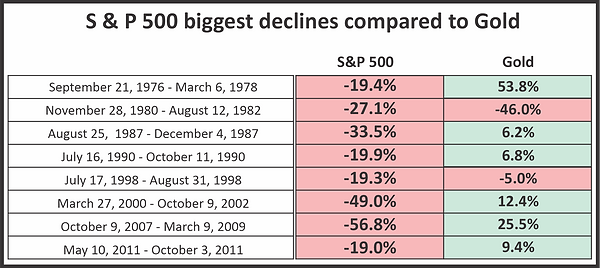

Want to hedge the stocks you own? Do you sometimes worry the stock market might crash? Gold may have an answer for you. If you want an asset that will rise when most financial assets fall, gold is likely to do that more often than not. The more common stocks you own, the more gold you need. Check out how gold performed in the 8 biggest stock market declines over the past 4 decades.

Gold's Performance During Stock Market Crashes You can see that in most cases, gold rose when the S&P crashed (gold’s only significant selloff, -46% in the early 1980s occurred just after its biggest bull market in modern history.)

It’s true the gold price initially fell in the shock of the 2008 financial crisis. But while the S&P continued to decline, gold sharply rebounded and ended the year up 5.5%. Over the total 18-month stock market sell off, gold rose over 25%. Gold doesn’t automatically rise with every downtick in the stock market, but history shows it is sought as a safe haven in big stock market declines.

10

Protect your Portfolio

One of gold’s strongest advantages is that it can protect your investments and even your standard of living during periods of economic, monetary, or geopolitical crisis. Depending on the nature of the crisis, gold can move from a defensive tool to an offensive profit machine. When a crisis strikes and drives fear higher—whether it’s from investors worried about the stock market or a full-blown event affecting the livelihood of all citizens, gold is a natural safe haven. Fear is what drives people in a crisis. The greater the worry the more gold is sought and the higher its price goes. A lot could be written about the various crises that are possible today, but the point is that the level of risk in our economic, fiscal, and monetary systems is elevated. There are so many risks, in fact, that the gold price is likely to make new all-time highs in response to some of these crises playing out.

Here’s the kind of potential gold has… the second half of the 1970s was a troubling period with interest rates over 15%, high unemployment, a 14% inflation rate, an energy crisis including an oil embargo, the Soviet invasion of Afghanistan, cold war tensions, and recessions at both the

beginning and end of that period. How did gold respond to all this? From its low in August 1976 to its January 1980 high, gold rose a whopping 721%!

bottom of page